This article will give a complete overview of the issues related to cheque dishonour or cheque bounce in particular the laws related to cheque dishonour, legal recourse for the dishonour of cheque, punishment, the liability of guarantor of a loan in case of cheque bounce etc in Bangladesh.

What is a Negotiable Instrument?

A negotiable instrument is any document guaranteeing the payment of money, paid either on demand or at a future date.

Types of Negotiable Instruments:

Promissory Note:

A promissory note is a written instrument signed by the maker containing an unconditional undertaking, to pay a certain amount of money to a certain person or to the bearer of the instrument at a fixed or determinable future time or on demand. The term ‘on demand’ means that a note is payable immediately or at sight.

Bill of Exchange:

a written instrument signed by the maker containing an unconditional order, directing a certain person to make payment of money to a certain person or to the bearer of the instrument at a fixed or determinable time or on demand. Such instrument shall contain an order to accept or to pay and the direction/order has to be accepted by the acceptor, without which such instrument will not be a bill of exchange.

Cheque:

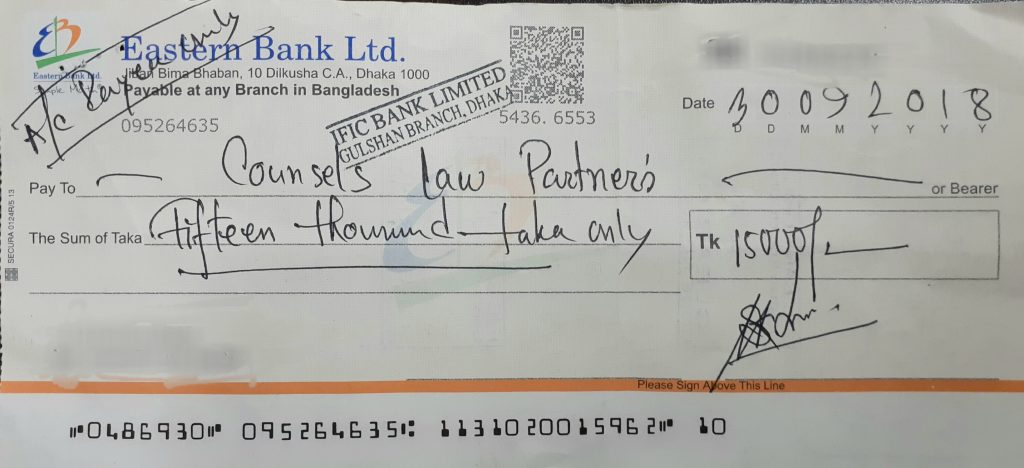

A bill of exchange is drawn on a specified banker and is payable only on demand; it is given for immediate payment.

Dishonour of Cheque

In simple terms when a cheque cannot be honoured and is returned by the bank due to insufficient funds then it amounts to a Cheque bounce or dishonour of the cheque. However, in legal terms, it amounts to the dishonour of a cheque when- a cheque drawn by a person on an account maintained by him with a banker for payment of money to another person from out of that account but the cheque is returned by the bank unpaid, either because of an insufficient fund or that it exceeds the amount arranged to be paid from that account by an agreement made with that bank, then it amounts to the dishonour of cheque which is an offence.

In addition, Cheques may be dishonoured for various other reasons which include-

- difference of amount in figure and word,

- stale cheque

- undated/post-dated cheque,

- drawer’s signature differs/ missing,

- payment stopped by drawer,

- forged endorsement

- account closed/dormant/blocked

- cheque not activated/intimation not received

- missing corporate stamp

- forged or unauthorized signature

Legal Framework for Cheque Dishonour

Offences relating to dishonour of cheques or cheque bounce are dealt with in light of the provisions of The Negotiable Instruments (N.I) Act 1881. This Act extends to the whole of Bangladesh. The Act is considered a special law, and its provisions shall prevail over any ordinary law.

Relevant law for Dishonour of Cheques:

(i). What actions can be taken for Cheque Dishonour?

In case of dishonour of the cheque, the drawee can file a case against the drawer. The plaintiff must decide where to file a lawsuit regarding dishonour of the cheque. The case must be filed in a Cognizance Magistrate Court. The branch of the bank to which the disputed cheque was presented must fall within the jurisdiction of that Court.

(ii). Steps to be taken for filing a Case under 138 of the NI Act

The conditions must be followed in order to file a case for cheque dishonour under sections 138 and 140 of the N. I Act are discussed below:

Step One: The cheque has to be presented to the bank within 6 months of issuance or within the period of its validity. In addition, it can be presented to the bank as many times as the drawer instructs the payee to present it.

Step Two: a notice in writing has to be sent to the drawer of the cheque, making a demand for payment, within 30 days from the date the cheque was returned/Dishonoured.

Step Three: the drawer will be given 30 days from the date of the notice to make the payment.

Step Four: if the drawer fails to pay within the time stipulated, then the drawee has to file a case within 30 days from the expiry of the 30 days time given to the drawer for payment.

Claim against Companies for Dishonour of Cheque:

If the offence under section 138 is committed by a company, then the company along with every person, who at the time of the offence was in charge or was responsible to the company, shall be liable for the offence under section 140 of the N. I Act.

Any person shall not be liable under section 140 if he proves that he had no knowledge of the offence being committed or that he took all reasonable steps to prevent the commission of the offence.

For a claim against a Company, serving a notice of dishonour on the firm will suffice; there is no need to serve notice on all partners involved in the commission of the offence.

Significant principles from case laws:

- Shah Alam v State [63 DLR (2011) 137] states that if the drawer of the cheque has malafide intention to dishonor the cheque, he will be liable under section 138 of the N.I Act.

- FaridulAlam v State [16 BLT (AD) 2008 held that if a person issues a cheque knowing that there is not sufficient fund in the account, he shall be liable and prosecuted under section 138 of the N. I Act. A similar view was expressed in Ahmed Lal Mia v State [66 DLR (AD) 204] and SM Redwan v Md. Rezaul Islam [66 DLR (AD) 169].

- The Apex Court in KhondokarMahtabuddin Ahmed v State stated that there can be no legal hindrance if a criminal case is filed where a civil suit is pending before the court on the same matter. It can be seen from the case of Anwarul Karim v Bangladesh where it was stated that section 138 of N. I Act has nothing to do with the recovery of the loan amount. The criminal case stands for the offence, while the civil suit is for the realization of money.

- In AbulKalam Azad v State (Metro sessions Case no. 152 of 2007), the court held that a single notice for several dishonored cheques is not acceptable and the rule has been made absolute.

- Recently, on 17 February 2020, the Appellate Division of the Supreme Court in disposing of an appeal provided that a valid reason for receipt of cheques must be given in order to impose liability. The cheque drawer has no obligation to pay the money to a cheque holder if the promise which was considered during issuing the cheque is not fulfilled.

The court said, “Where the amount promised shall depend on some other complementary facts or fulfilment of another promise and if any cheque is issued on that basis, but that promise is not fulfilled it will not create any obligation on the part of the drawer of the cheque or any right which can be claimed by the holder of the cheque.” Therefore, the complainant has to prove consideration on his part in order to claim the amount promised by the drawer in the cheque.

Punishment for Cheque Dishonour

The punishment for the offence under the Negotiable Act 1881 is imprisonment for a term which may extend to one year, or with a fine which may extend to thrice the amount of the cheque or with both.

Restrictions to filing an appeal

No appeal against an order of sentence under section 138(1) shall lie unless the drawer deposits 50% or more of the dishonoured amount before filing the appeal in the court awarding the sentence.

What happens when the drawer of the cheque dies?

The drawer dies during the N. I case:

The case gets over on the death of the accused and the only remedy left with the complainant is to file a civil case against the legal heirs of the accused person. This is because of the case under section 138 of the N. I Act is criminal in nature and criminal liability cannot be shifted to the legal heirs of the accused person.

Drawer dies during the appeal case:

If the drawer of the cheque dies during the pendency of the appeal case, then the appeal (except an appeal from a sentence of fine) shall abate. The complainant has to file a case in the civil court for recovery of money under the sentence of a fine against the legal heirs of the deceased accused.

Alternative remedies available when the cheque is outdated:

If a cheque is not being presented before the bank and is dishonoured within the time specified in the act, then the cheque becomes outdated. When a cheque becomes outdated and it is not possible to file a case under the Negotiable Instrument Act 1881, then there are four other alternative ways through which you can seek remedies. The holder in due course can take the following actions:

(i). Cases under sections 406 and 420: the holder in due course can file a case for Breach of Trust and Cheating.

(ii). Money Suit: the limitation period for a money suit is 3 years. Therefore, even if the holder in due course cannot file a case under the NI. Act but he will have the option to file a civil suit for claiming the money.

(iii). Summary Suit: as per order 37 of the Code of Civil Procedure, cheques are a negotiable instrument. Therefore, the holder in due course can file a summary suit before the district judge which will be summarily disposed of. The limitation period for the summary suit is also 3 years.

Can a guarantor of a loan be held liable for the Dishonour of the Cheque issued by the loanee?

One or more guarantors are required alongside the borrower at the time of approval of the loan by the bank. It is a settled principle of law that for the dishonour of a cheque issued by the loanee, actions under section 138 of N.I Act cannot be brought against the guarantor. However, he may incur civil liability to pay the debt guaranteed by him; Hardeep Singh Nagra v State & another. The guarantor of the loan will pay the borrowed amount if the borrower fails to do so. In order to make such payment, if the guarantor issues a cheque, he is liable under section 138 if his cheque is dishonoured on presentment for encashment.

Arbitration and Cheques Dishonour:

The arbitration clause in agreements:

If any party to the arbitration institutes any legal proceeding against the other party on any matter agreed upon in the agreement, Section 7 of the Arbitration Act 2001 states that whatever the current law in force directs, they will be treated as non-obstante clause and the court shall not have jurisdiction to hear any other legal proceedings other than the provisions of the Arbitration Act 2001.

Negotiable Instruments Act 1881 and Arbitration Act 2001:

Both the N. I Act and Arbitration Act 2001 are special laws. The N.I. The act contains provisions for filing criminal cases for offences that fall under this Act. On the other hand, arbitration proceedings are considered civil matters. Moreover, according to customary law, if any dispute arises between ordinary law and special law, unless stated otherwise the special law shall always prevail; Hashmat Ullah v Azmir Bibi and others (44 DLR 332, 337), Managing Director, Rupali Bank and others v Tofazzal Hossain and others [44 DLR (AD) 260, 263].

Probir Roy v State of West Bengal [ II (1996) BC 308 (Cal)] states “An arbitration clause does not cover a criminal proceeding. So the trial for a criminal offence cannot be avoided on the plea of an arbitration agreement”.

According to Shahnewaz Akhan v The State and another [19 BLT (HCD) (20110 349], “there is no legal bar in filing a criminal case for criminal liability notwithstanding the fact that a civil suit is pending over a self-same matter.”Even if there is an arbitration clause in the agreement, an aggrieved person can file a criminal case. The court in Mohd. Majharul Hoque Monsur v Mir Kashim Chowdhury and another [2016 (2) LNJ 259, 261-262]took similar views.

The writ petition in the existence of arbitration clause:

A party to an agreement cannot file a writ petition at the High Court Division if the agreement contains clear guidelines for the settlement of the dispute; Md. Mobarak Hossain v The State and others [2011 (XIX) BLT (HCD) 54,60].

Quashing a case filed under section 138 of N. I Act:

An arbitration proceeding is a civil proceeding and as such, because of the pendency of an arbitration proceeding it is not proper to quash a prosecution under section 138 of the N.I Act; Sri Krishna Agencies v State 2009 Cr LJ 787(SC).

Section 138 read with section 7 of Arbitration Act 2001:

The High Court Division in Mohammad Majharul Hoque Munsur v Mir Kashim agreed that arbitration proceedings and section 138 prosecution can run at the same time without any form of a legal barrier. [Shahnewaz Akhand v The State, 19 BLT (HCD) 349].

The Apex Court in Khondokar Mahtabuddin Ahmed v State stated that there can be no legal hindrance if a criminal case is filed where a civil suit is pending before the court on the same matter. It can be seen from the case of Anwarul Karim v Bangladesh section 138 of N. I Act has nothing to do with the recovery of the loan amount. The criminal case stands for the offence, while the civil suit is for the realization of money.

If you want to know more about it please visit: Cheque Dishonour Law in Bangladesh or CHEQUE DISHONOUR CASE IN BANGLADESH

Legal Service regarding N. I Act cases by CLP:

The Barristers, Advocates, and lawyers at CLP in Gulshan, Dhaka, Bangladesh are highly experienced at assisting clients through the entire process related to cases under the N. I Act in Bangladesh. For any queries or legal assistance, please reach us at E-mail: info@counselslaw.com

Phone:+8801700920980. +8801947470606. Address: House 39, Road 126 (3rd Floor) Islam Mansion, Gulshan 1, Dhaka.