Company registration in Bangladesh is a popular query from foreign investors. Furthermore, people want to know the period of business formation and the costs for its incorporation in Dhaka, Bangladesh. Therefore, this article will focus on guidance on how to register a private limited company in Bangladesh and complete the steps of company formation in Bangladesh.

For any queries or legal assistance, please reach us at E-mail: info@counselslaw.com Phone:+8801700920980. Address: House 39, Road 126 (3rd Floor) Islam Mansion, Gulshan 1, Dhaka.

Types of Companies to Register in Bangladesh

There are five ways of doing business in Bangladesh. They are as follows:

- Private Limited Company

- Public Limited company

- Branch office

- Liaison Office

- Proprietorship

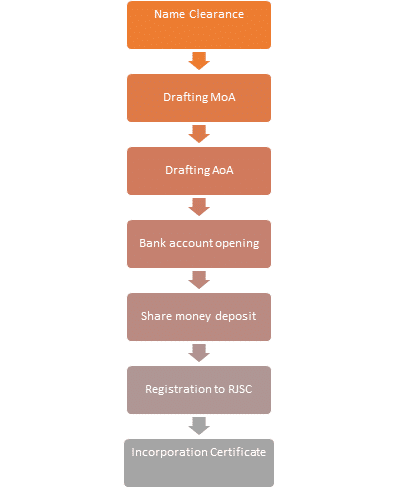

Steps to form a private limited company in Bangladesh

Name clearance

Getting a name-clearance certificate usually takes 1 to 2 days. Currently, the government fee for name clearance is 230 BDT or 3 USD.

Drafting Memorandum of Association

Drafting a Memorandum of Association (MOA) of a limited company is a very important part of company registration. MOA includes the objectives of a company. One can add as many objectives as one wants in the MOA.

Drafting Article of Association

Article of Association (AOA) is the constitution of the company. As a result, AOA contains all the rules of how a limited company will run and who will be the Managing director, Chairman, and Director of the company.

Bank account opening (for foreign nationals/entities)

To register a company in Bangladesh by a foreign investor, a provisional bank account under the proposed company name with the recognized bank is mandatory.

Documents required for Bank Account

- Photocopy of name clearance certificate

- Draft AOA and MOA

- Photocopy of passport (application by foreign nationals)

- Photo of Directors

- Board Resolution

Share money deposit

After opening the provisional bank account, a share money deposit will be sent from the country of the foreign shareholder to the provisional account. Subsequently, the money is required to be sent from the person or entity account of the shareholder. After receiving the payment the bank in Bangladesh will issue an encashment certificate.

Registration with RJSC

After receiving the encashment certificate, a few documents need to be submitted to the RJSC namely AOA, MOA, and encashment certificate along with all other necessary information. Thereafter, RJSC will generate an invoice to be paid to the recognized bank will generate an invoice to be paid to the recognized bank.

Required documents for online company registration

Required documents to form a limited company in Bangladesh are as follows:

- Identification of Directors i.e. name, parent’s name, passport, email ID, mobile number

- Details of Managing Director

- Particulars of Chairman

- NID (if Bangladeshi national)

- TIN (if Bangladeshi national)

- Limit of paid-up capital

- Limit of authorized capital

- Photo of all shareholders (1 copy)

- Address of company

- Signatories of the bank account

Government cost

The government cost for registration depends upon the authorized capital of the company. For instance, if the authorized capital is 50 lakh, then, the government fee will be BDT 13570 or USD 160 along with 15% VAT. You can find the government fee for Bangladesh company registration.

Incorporation certificate

Complying above all, RJSC will verify all the information given in the AOA and MOA. Similarly, RJSC will verify the encashment certificate with the bank as well. After being satisfied with all the information, the RJSC will issue an incorporation certificate under the name of the company.

Post Company registration

TIN (Tax Identification Number)

After receiving the incorporation certificate, an application needs to be made to the National Board of Revenue (NBR) for a tax identification number. After that, a tax certificate will be issued under the name of the company within 1 (One). Government cost is not necessary to get a TIN Certificate.

Trade license

To get a trade license, an application needs to be made to the concerned city corporation. Along with the application, the following information needs to be submitted:

- Photocopy of AOA and MOA

- Photo of Managing Director or Chairman

- TIN of the company

- Rental agreement

- Nature of business

Time to Trade License

It usually takes 3 to 4 working days to get a trade license. To know more about how to get a trade license in Bangladesh.

Business Identification Number (BIN)

After receiving all the documents, the Company needs to apply for a BIN or VAT certificate. It may take 5 to 7 working days to get a BIN or VAT certificate.

Bank account opening (for Bangladeshi nationals/entities)

To open a bank account under the name of the company, a Bangladeshi national needs to submit the incorporation certificate, AOA, MOA, TIN, and Board resolution to the bank. Thereafter, a bank account will be opened under the name of the company and the company can start transactions with the bank. Similarly, the company needs to apply for a Business Identification Number (BIN) for VAT purposes. After that, the company can smoothly run its business in Bangladesh!!!! If you want to know more about company setup in Bangladesh.

Legal Advice concerning company registration in Bangladesh by CLP:

Counsels Law Partners (CLP) is a leading law chamber in Bangladesh. Certainly, CLP is an expert in registering companies in Bangladesh by investors. For any queries or legal assistance, please reach us at E-mail: info@counselslaw.com

Phone:+8801700920980. +8801947470606. Address: House 39, Road 126 (3rd Floor) Islam Mansion, Gulshan 1, Dhaka.

Indeed a very well-written article! It gave me a proper understanding on how to form a private limited company in Bangladesh.

Thank you Anika.

Thanks a lot! This is an astonishing web site.

Heya i’m for the first time here. I came across this board and I find It truly useful & it helped me out much. I hope to give something back and help others like you helped me.

The tips is rather useful.

Thanks for your comment.

No matter if some one searches for his vital thing, so he/she wants to be available that in detail, so that thing is maintained over here.

Thank you.

Heya i’m for the first time here. I found this board and I find It truly useful & it helped me out a

lot. I hope to give something back and help others

like you helped me.

Thank you.

I’m not that much of a online reader to be honest but your blogs really nice, keep it up!

I’ll go ahead and bookmark your site to come back later on. All the best

Thanks for your comment.

Wonderful site you have here but I was wanting to know if you knew of

any forums that cover the same topics talked about here? I’d really like

to be a part of community where I can get feedback from other knowledgeable people that share the same

interest. If you have any suggestions, please let me

know. Bless you!

Thank you. You can read Company Law 1994 and visit https://roc.portal.gov.bd/