How to set up a Company in Bangladesh? There are many ways to set up a business under the Company Act 1994 in Bangladesh, Private Ltd Company, Public Ltd Company, proprietorship, branch office, liaison office, etc. This article focuses on how to set up a Private Ltd company in Bangladesh. The following must be followed to set up a Company in Bangladesh?

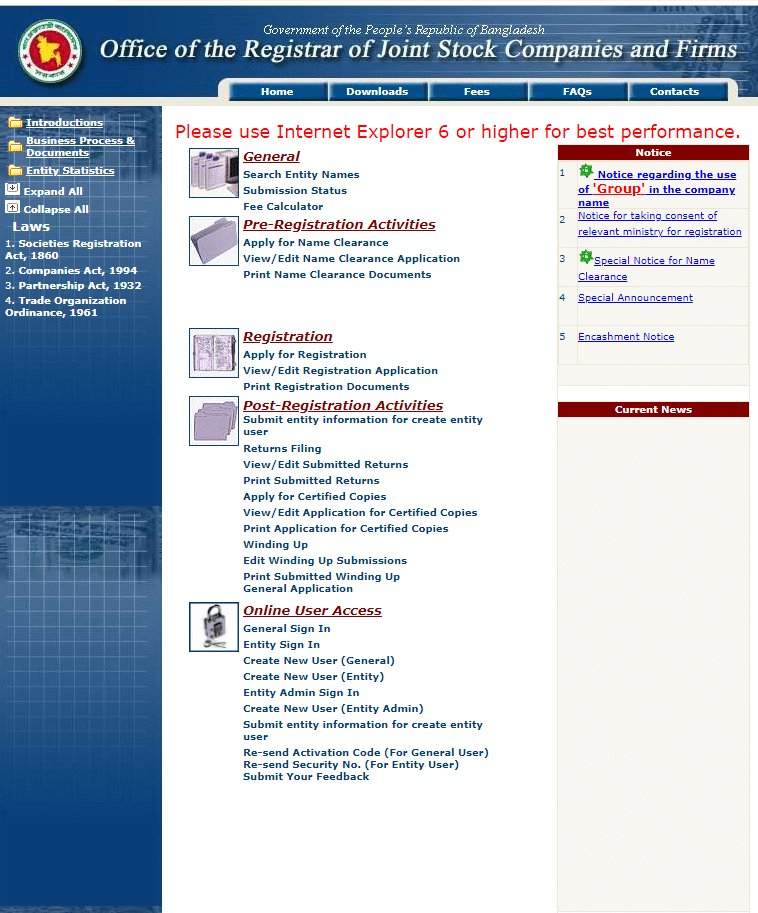

Setting up a company in Bangladesh involves a formal process of Company Registration with the Registrar of Joint Stock Companies and Firms (RJSC). This includes adhering to Business Formation Procedures and submitting documents such as the Memorandum of Association and Articles of Association.

Approval from the Board of Investment (BOI) may be necessary, and compliance with National Board of Revenue (NBR) requirements is crucial, including obtaining a Tax Identification Number (TIN) and registering for Value Added Tax (VAT).

How to set up a Company in Bangladesh

- Name Clearance

- Drafting Documents

- Filing with RJSC

- Government Fees

- Incorporation Certificate

- Tax Identification Number (TIN)

- Trade License

- Bank Account Opening

Following these steps, you can learn How to set up a Company in Bangladesh. Just read the full context, the processes will help you know everything related to the company setup.

Businesses can choose structures like Private Limited, Public Limited, Sole Proprietorship, or Partnership. Understanding Corporate Income Tax, eligibility for Tax Holidays, and compliance with labour laws are essential.

Additionally, securing a business bank account, following Foreign Exchange Regulations, obtaining necessary licenses like Trade License, and protecting intellectual property through Trademark Registration complete the process. Each step is vital for a successful and legally compliant business establishment in Bangladesh.

The government fee for name clearance is 200 Taka + (15%) = 230 Taka. It usually takes about 2 days to receive the name clearance certificate. Further, the company must be formed within 1 month after getting the name clearance certificate.

Name Clearance

After getting the name clearance, the objectives of the company have to be provided. In the meantime, the Articles of Association and Memorandum of Association have to be drafted. This is like the constitution of the company. Therefore, it is advisable to use qualified and experienced lawyers for drafting well-defined Articles of Association and Memorandum of Association. As per Bangladesh Company law, at least two directors are required to form a company in Bangladesh.

Drafting Documents

After finalizing the Articles of Association and Memorandum of Association of the company, the applicant needs to file Form XII, Photo of shareholders, office address, etc to the Registrar of Joint Stock Companies And Firms (RJSC).

Filing with RJSC

Thereafter, the government fee needs to be the designated Bank. Government fee depends upon the amount of authorized capital. For example, the government fee for authorized capital BDT. 5,00,00,000 will be BDT. 49,570 + 15% VAT. Similarly, the government fee for authorized capital is BDT. 1,00,00,000 will be BDT—17,570 +15% VAT.

Government Fees

As per RJSC Rule, after receiving the money, the RJSC authority will issue the incorporation certificate or reject the application within 28 days from the date of depositing the government fees. However, attempts can be made for pursuing to complete the process within 7 (Seven) working days from the date of depositing the government fee.

Incorporation Certificate

After getting the incorporation certificate, an application for the Tax Identification Number (TIN) of the Company has to be made. The certificate will be issued within 1 day.

Tax Identification Number (TIN)

A trade license application must be submitted by submitting the relevant papers and government fees. Hopefully, the trade license will be issued within 3- 5 working days from the date of application. If you want to know more about trade licenses.

Trade License

Thereafter, the incorporation certificate and trade license along with board resolution has to be submitted to the Bank for opening a bank account under the name of the company. After that, one can start their business!

FAQ

What is the first step in forming a Private Limited Company in Bangladesh?

How much does it cost to get name clearance for my company?

Are there any specific requirements for the Memorandum of Association and Articles of Association in Bangladesh?

How many directors are required to form a Private Limited Company in Bangladesh?

What are the government fees for registering a company with a certain amount of authorized capital?

How long does it take to receive the incorporation certificate from RJSC?

What is the process for obtaining a Tax Identification Number (TIN) for the company?

How can I acquire a trade license for my company in Bangladesh?

What is needed to open a bank account for the company?

Can I get legal assistance for setting up my company in Bangladesh?

Company formation at CLP

The Barristers, Advocates, and lawyers at CLP in Gulshan, Dhaka, Bangladesh are highly experienced at assisting clients through the entire process relating to the formation of a company in Bangladesh. For queries or legal assistance, please reach us at:

- E-mail: info@counselslaw.com

- Phone: +8801700920980 | +8801947470606

- Address: House 39, Road 126 (3rd Floor) Islam Mansion, Gulshan 1, Dhaka.