Manufacturing Company set process in Bangladesh by foreign or local investors, how to set up an industry in Bangladesh, and the cost of setting up a manufacturing company or industry in Bangladesh by foreign investors- are the most frequently asked questions to a Company Lawyer in Dhaka, Bangladesh.

In addition, people also ask about the legal requirements and compliances of a manufacturing company, the required documents for BIDA registration, and other certificates and permissions for setting up an industry or manufacturing company in Bangladesh. This article will focus on the steps and procedures of setting up an industry or manufacturing company in Bangladesh by foreign and local investors.

A. Steps to form a Manufacturing Company or Industry:

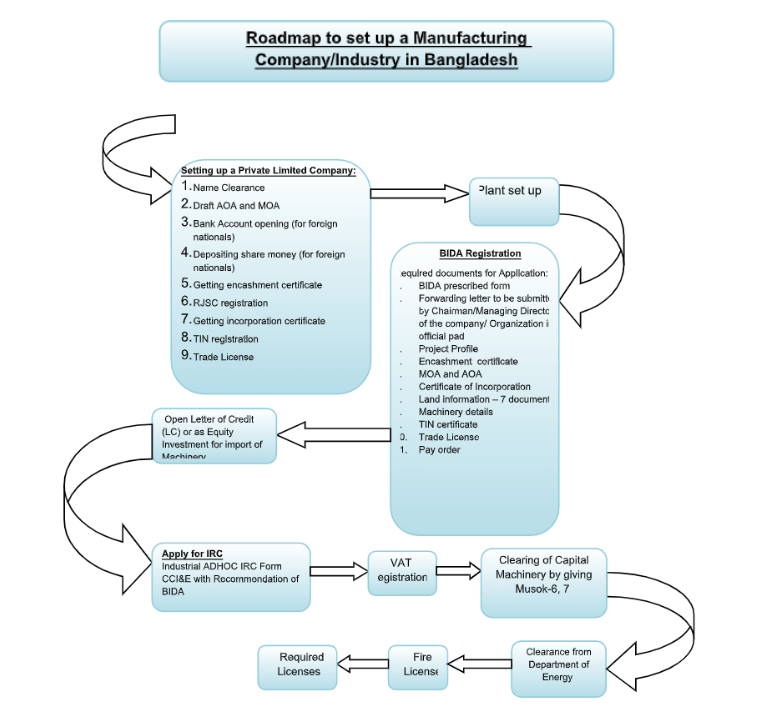

In the broader sense, to set up a Manufacturing Company or industry the following steps need to be followed:

a) Setting up a Limited Company

b) BIDA Permission

c) Required licenses

A road map is given below that will give a clear idea of the setup process of an industry/manufacturing company.

Now each of these steps will be explained in detail including the cost, time, and documents required for each step.

B. Setting up a Limited Company

Step One: Name clearance

At first, to form a private limited company, a unique selected name is required to be approved by Joint Stock Companies and Firms (RJSC).

a) Time

It usually takes 1 to 2 days to get the certificate.

b) Cost

Currently, the government fee for name clearance is 230 BDT or 3 USD including VAT.

Step Two: Drafting MOA and AOA

The Memorandum of Association (MOA) of a limited company includes the objectives of a company. One can add as many objectives as one wants. On the other hand, the Article of Association (AOA) is the constitution of the company. An AOA contains all the rules of how a limited company will run and the Managing director, Chairman, etc. of the company.

a). Time

It takes two days to draft the MOA and AOA.

Step Three: Bank account opening (for foreign nationals or entities)

At what stage one can open a bank account, will defer between foreign nationals/entities and Bangladeshi nationals?

a) Documents Required for Bank Account:

- Photocopy of name clearance certificate

- Draft AOA and MOA

- Photocopy of passport (application for foreign nationals)

After receiving the documents mentioned above, the bank will open a provisional account in the name of the company.

b) Time

It takes one day to open a bank account in Bangladesh.

Step Four: Depositing share money (for foreign nationals or entities)

After opening the provisional bank account, a share money deposit will be sent from the country of the foreign shareholder to the provisional account. Thereafter, the Bank will issue an encashment certificate.

Step Five: Registration to RJSC

After receiving the encashment certificate, a few documents need to be submitted to the RJSC namely AOA, MOA, and encashment certificate along with all other necessary information. After receiving all the necessary documents and information, RJSC will generate an invoice to be paid to the recognized bank.

a). Documents required:

- AOA and MOA

- Encashment certificate

- Particulars of Directors i.e. name, parents name, passport number, email ID, mobile number

- Name of Managing Director

- Name of Chairman

- NID (if Bangladeshi national)

- TIN (if Bangladeshi national)

- Limit of paid-up capital

- Limit of authorized capital

- Photo of all shareholders (1 copy)

- Address of company

- Signatories of the bank account

b). Cost of filing documents to RJSC:

The registration filing fee is BDT 1200 (one thousand and two hundred takas).

c). Government cost for registration:

It depends upon the authorized capital of the company. For instance, if the authorized capital is 50lakh, the government fee will be BDT 13570 (thirteen thousand five hundred and seventy takas) or USD 160 (one hundred and sixty takas) along with 15% VAT.

d). Incorporation certificate:

After receiving all the above-mentioned documents, RJSC will verify all the information given in the AOA and MOA and will also verify the encashment certificate with the bank. After being satisfied with all the information, the RJSC will issue an incorporation certificate in the name of the company. At this stage, the formation of a limited company is completed. However, to do business in Bangladesh, a few other compliances need to be complied with.

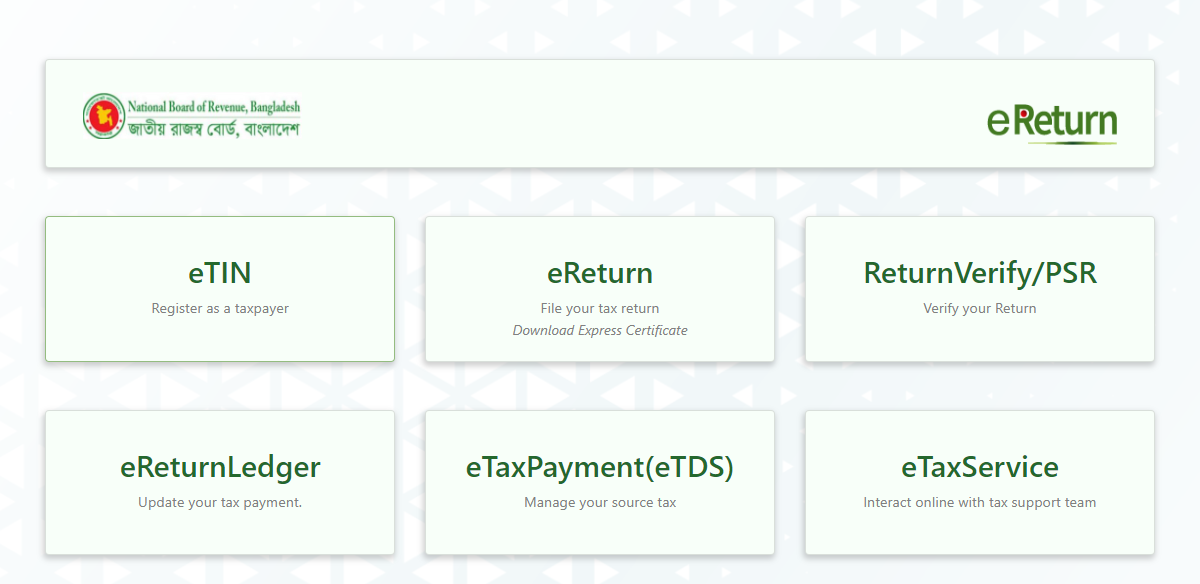

Step Six: Tax Identification Number (TIN)

After receiving the incorporation certificate, you have to make an application to be made to the National Board of Revenue (NRB) for a tax identification number. Upon receiving the application, a tax certificate will be issued under the name of the company.

Step Seven: Trade license

To get a trade license, an application needs to be made to the concerned city corporation. This is required to do business in Bangladesh.

a). Documents:

Along with the application, the following information needs to be submitted:

- Photocopy of AOA and MOA

- Photo of Managing Director or Chairman

- TIN of the company

- Rental agreement

- Nature of business

b). Time

It usually takes 3 to 4 working days to get a trade license.

BIDA Registration

Thereafter, the investor is required to apply to the Bangladesh Investment Development Authority (BIDA) for registration. Implementing a private sector industrial project in Bangladesh either local, joint venture, or 100% foreign, has to be registered with the BIDA.

a). Process Step

Step 1: Collect a local investment registration form from the Registration & Investment Division of BIDA

Step 2: Deposit the Registration fee, as per the fee schedule from any scheduled bank in favour of the Bangladesh Investment Development Authority and collect a pay order/bank order

Step 3: Submit the completed application form with supporting documents to the concerned section

Step 4: BIDA reviews the application and documents

Step 5: If the application is approved, the Registration Certificate will be issued

b). Documents required for BIDA registration:

- Forwarding letter to be submitted by Chairman/Managing Director of the company/ Organization in official pad;

- Application in the prescribed form of BIDA duly filled in;

- Certificate of Incorporation;

- Copy of Trade License issued by the concerned authority of the factory location mentioning specific sector;

- Copy of TIN Certificate of the company;

- List of Machineries Local & Imported to be submitted in the official pad of the company (SL No, Name of Machine, H.S Code, Quantity and value (in million Tk./US$) );

- Encashment certificate;

- According to the industrial policy, 2016 NOC from the concerned Ministry/Directorate/ Department for the controlled sector is to be submitted (if required);

- Pay order/Bank draft in favour of “Bangladesh Investment Development Authority (BIDA)”;

All documents (Except Bank Draft) must be attested by the Chairman/ MD of the company

c). Time

Time 15-30 working days to get BIDA approval.

d). Investment Fee

| Investment Amount | Required Fee (BDT) |

| Up to Tk. – 10 Core | 5,000 |

| 10 Core Tk. – 25 Core | 10,000 |

| 25 Core Tk. – 50 Core | 25,000 |

|

50 Core Tk. – 100 Core |

50,000 |

| 100 Core Tk. – Above | 1,00,000 |

Tax Holiday

Tax holiday facilities will be available for 5 or 7 years depending on the location of the industrial enterprise. For industrial enterprises located in Dhaka and Chittagong Divisions (excluding Hill Tract districts of Chittagong Division) the tax holiday facility is for 5 years while it is 7 years for locations in Khulna, Sylhet, Barisal, and Rajshahi, Divisions, and the 3 Chittagong hill districts.

Tax holiday facilities are provided by existing laws. The period of tax holiday will be calculated from the month of commencement of commercial production. A tax holiday certificate will be issued by the NBR (National Board of Revenue) for a total period of 90 days of submission of the application.

Accelerated Depreciation

Industrial undertakings not enjoying tax holidays will enjoy accelerated depreciation allowance. Such allowance is available at the rate of 100 per cent of the cost of the machinery or plant if the industrial undertaking is set up in the areas falling within the cities of Dhaka, Narayangonj, Chittagong, and Khulna and areas within a radius of 10 miles from the municipal limits of those cities. If the industrial undertaking is set up elsewhere in the country, accelerated depreciation is allowed at the rate of 80 per cent in the first year and 20 per cent in the second year.

Value Added Tax (VAT) Certificate

To carry out normal business operations in Bangladesh after the formation of a private limited company, the company must have a unique Business Identification Number (BIN).

Therefore, to get a Business Identification Number, companies are required to have a VAT registration certificate. VAT is regulated by the Customs, VAT, and Excise Department of the National Board of Revenue (NBR). Applying for VAT registration is free.

a). Documents

- TIN Certificate

- Trade License

- Import/export Registration certificate

- Passport sized photos

- Deed of Agreement

- Bank solvency certificate

- BOI registration

- Memorandum and Articles of Association

Every private limited company needs to pay the VAT on the 15th (fifteen) of every consecutive month. Once a Private Limited company is formed and is ready to do business in Bangladesh, the next step is to get approval from BIDA for foreign investments

How to get a Fire License?

Fire License is a mandatory license required for all factories in Bangladesh. The Fire License in Bangladesh is issued by the Fire Service and Civil Defense (FSCD).

a). Documents:

The documents that must be submitted for a fire license are:

- Prescribed application form

- Trade license

- Treasury Challan or Demand note

- Yearly Valuation Certificate from the relevant City Corporation or Municipality’s zonal office.

- Deed of Agreement and receipt of rent

- The establishment layout is authorized by RAJUK or City Corporation or the relevant municipality’s zonal office.

- Certificate of Incorporation and Memorandum of Association

- No-Objection-Certificate (NOC) from a local representative

- Clearance certificate from the FSCD office.

- Additional form (in case of garment factories)

b). Government Cost

The government fee for a fire license varies depending on the type of factory establishment and assessment by the officer of FSCD.

c). Procedure for getting a Fire license

- Step one: the prescribed application form will have to be submitted to the FSCD office along with supporting documents.

- Step two: thereafter FSDC authority will visit the establishment and will issue the demand note.

- Step three: The applicant then has to pay the amount prescribed in the Demand note to the bank.

- Step four: the next step is to submit the bank receipt slip to the FSDC office. Upon receiving that the inspector will re-inspect the establishment. As such, upon being satisfied that the establishment fulfils the standard requirement of fire safety, a fire certificate will be issued by FSDC.

d). Time

Issuance of a Fire license usually takes a maximum of 120 (one hundred and twenty) working days. It is to be noted that the fire license is to be renewed by the FSCD office every year. To know in detail about the process of getting other licenses mentioned above contact Counsels Law Partners. A brief idea about the process has been given in this article.

Required License

After the formation of a limited company along with BIDA permission, now all the required licenses necessary for setting up any industry/ manufacturing company must be obtained. All the required licenses are listed below:

- Become a member of the concerned business association

- Export and/ or import license

- Permission from a concerned government authority (for example; telecommunication business approval from BTCL, etc)

- Fire license for factory setup or corporate office from Fire Service and Civil Defense (FS&CD)

- Miscellaneous permission (vary case to case) for business setup in Bangladesh;

- Environmental clearance certificate from the Department of Environment. To learn how to get an Environmental clearance certificate click here.

- Factory Layout Approval & License from the Office of the Chief Inspector of Factories and Establishment (CIFE)

- Tax holiday certificate from NBR

- Trade Mark Registration

- Bonded Warehouse License from Customs Bond Commissionerate (CBC)

- EPB Certificate from the Export Promotion Bureau (EPB)

- Electrical Connection document

- Gas connection document

- Bangladesh Energy Regulatory Commission permission

- Building:

- Architectural Approval Drawing

- Structural Drawing

- Soil Test Report

- Occupancy Permission

- Engineering Certificate

- Load Bearing Certificate

xvi. Compliances issues:

- Safety

- Security

- Standard

LEGAL ADVICE ON FDI/COMPANY MATTERS AT CLP

The Barristers, Advocates, and lawyers in Gulshan, Dhaka, Bangladesh are highly experienced in dealing with matters related to FDIs and Company/ Industry formation. In addition to handling various issues related to domestic clients regularly, it also has experience in consulting and assisting numerous international clients with utmost care and attention throughout their legal troubles. For queries or legal assistance, please reach us at:

Do You Need Help with Legal Advice regarding setting up a private limited company in Bangladesh, CLP will help you with the process. Send us your requirements here or Call us